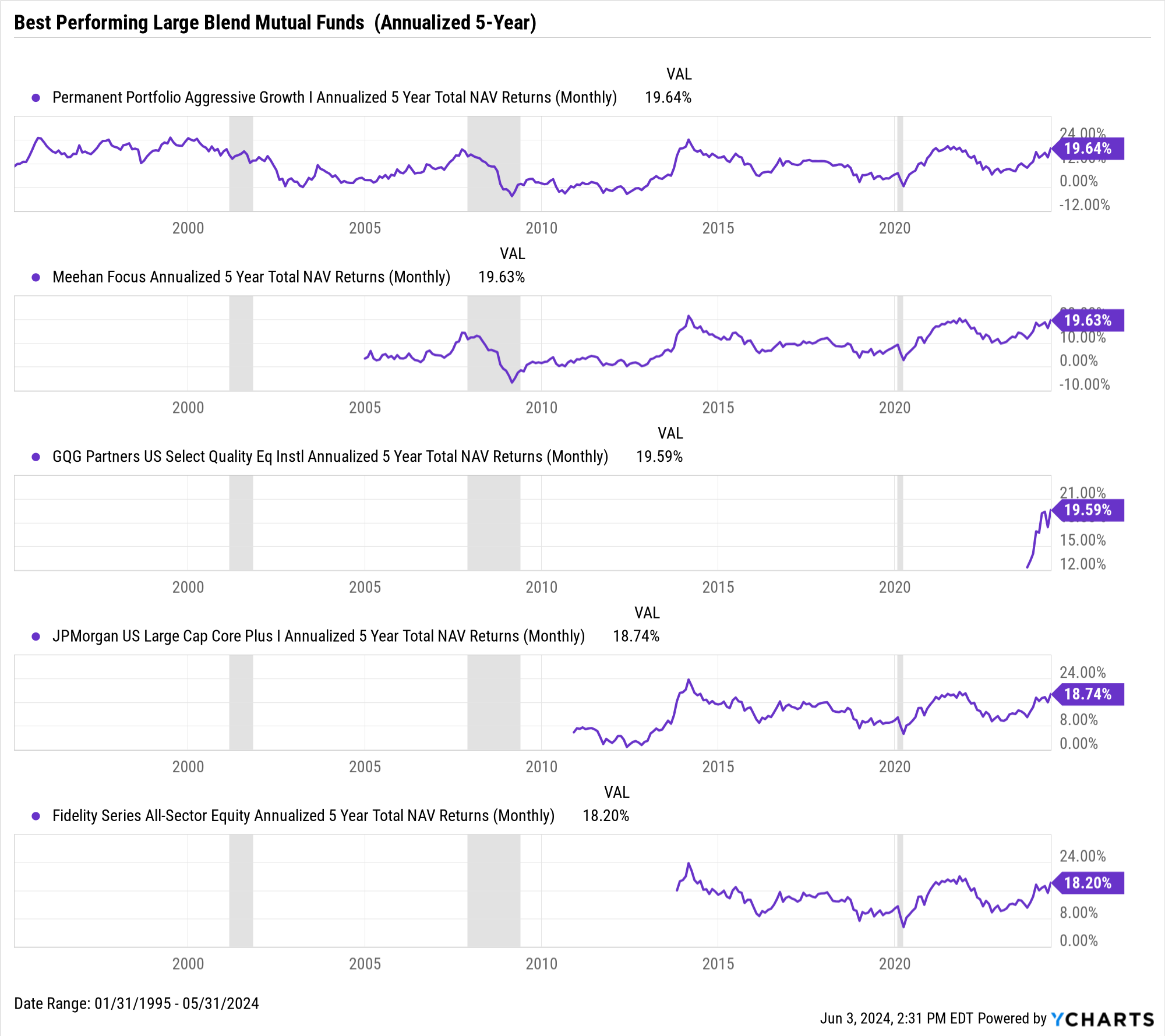

Websee vanguard growth index fund (vigax) mutual fund ratings from all the top fund analysts in one place. Keep reading on to see how different (or perhaps similar) these two funds are. Webvfiax pays higher dividends than vigax: Vfiax (1. 32) vs vigax (0. 53). Vfiax was incepted earlier than vigax : Vfiax ( 24 years ) vs vigax ( 24 years ). Webvigax does have an outrageous ytd, but who knows how sustainable it is. The etf equivalent of vfiax is voo, which is the darling of most investing subs since the sp500. Webover the past 10 years, vviax has underperformed vigax with an annualized return of 10. 82%, while vigax has yielded a comparatively higher 15. 62% annualized return.

Recent Post

- Braiding Parting Pattern

- Jonkhoff Funeral Home

- Uhaul Twentynine Palms

- Math Minor Ucla

- Abandoned Schools In Detroit For Sale

- It Helpdesk Jobs Remote

- Prices On Uhaul Trailers

- Spca Clovis Ca

- Gucci Group Careers Nyc

- Kroger Fresh Flowers

- Driving Directions To Cracker Barrel

- Norwalk Ohio Police Dept

- Splunk Search Multiple Indexes

- Ecosystem In A Shoebox Projects

- Fedex Jobs Lake Charles La

Trending Keywords

Recent Search

- Boone And Crockett Score

- Virtua Er

- Diamond Art Kits Hobby Lobby

- Big Lots Charge Card

- Rent A Center On Pendleton Pike

- Youtube Ear Blackheads

- Bvu Outage Map

- Jobs That Pay Over 200k A Year

- Steamboat Today Obituaries

- Fed Ex Dropp Off

- Nc Inmate Search Wake County

- Houses For Rent By Landlord Near Me

- Electrician Job Hiring

- Denton County Drivers License Renewal

- Citrus Nails Bay Area