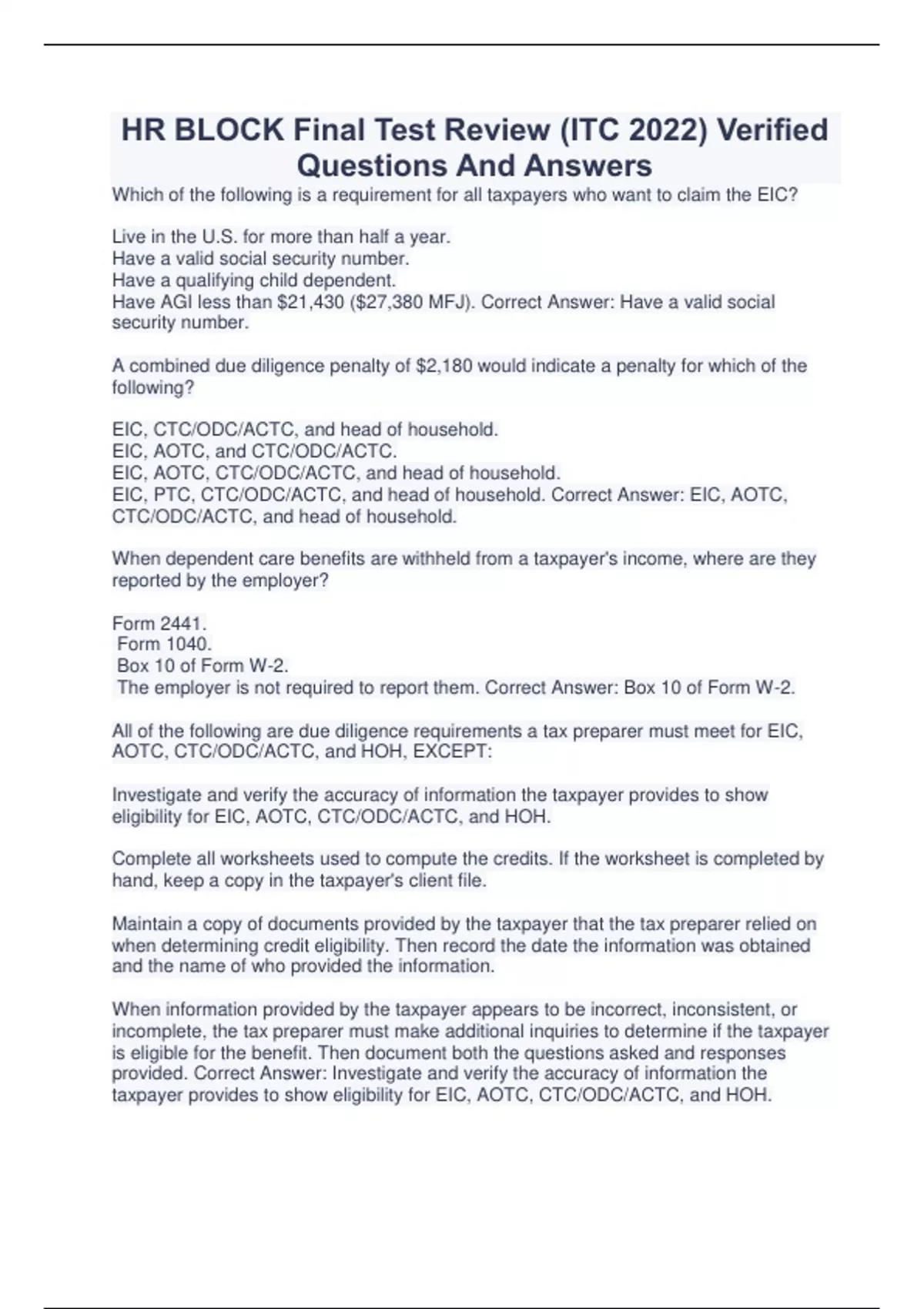

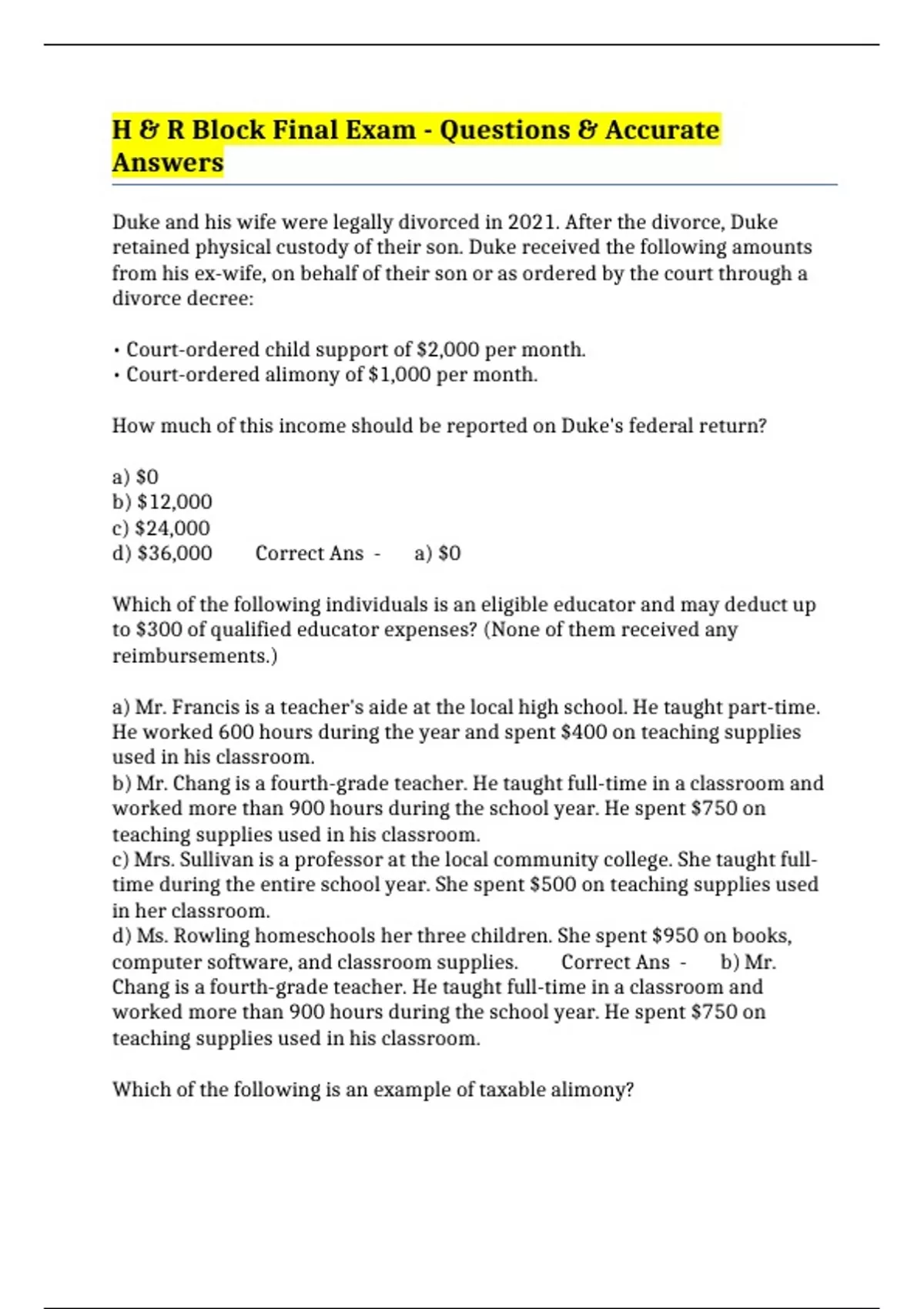

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Clerk Of Court Whiteville Nc

- Richard Alexander Murdaugh Jr

- Quality Portable Buildings Of Andalusia

- Ecr Pima

- Harry Potter Harry And Hermione Fanfiction

- New Love Memes For Him

- Marsh Funeral Home Luckey

- Salt River Electric Report Power Outage

- Dr Earle Miami Deaths

- Cicero Shooting

- Driving Jobs At Ups

- Frankfort Patch Il

- Dod Initial Orientation And Awareness Training Answers

- 2 Bedroom Apartments With Utilities Included

- Xfintiy

Trending Keywords

Recent Search

- Dinarrecaps Com Our Blog

- Defense Rankings Week 10

- Wausau Herald Obituaries

- Are Misaligned Bills Worth Anything

- Andrew Weissmann Twitter

- Nclottery Com 2nd Chance

- Fnaf Security Breach Fanfiction Gregory Adopted

- Green Bay Wi Arrest Records

- Chandler Pd Scanner

- Erath County Burn Ban

- Make Me Pregnant Dad

- Social Security Benefits Payment Calendar

- R Stopdrinking

- Best Rookies To Draft In Dynasty 2024

- San Bernardino County Court Calendar