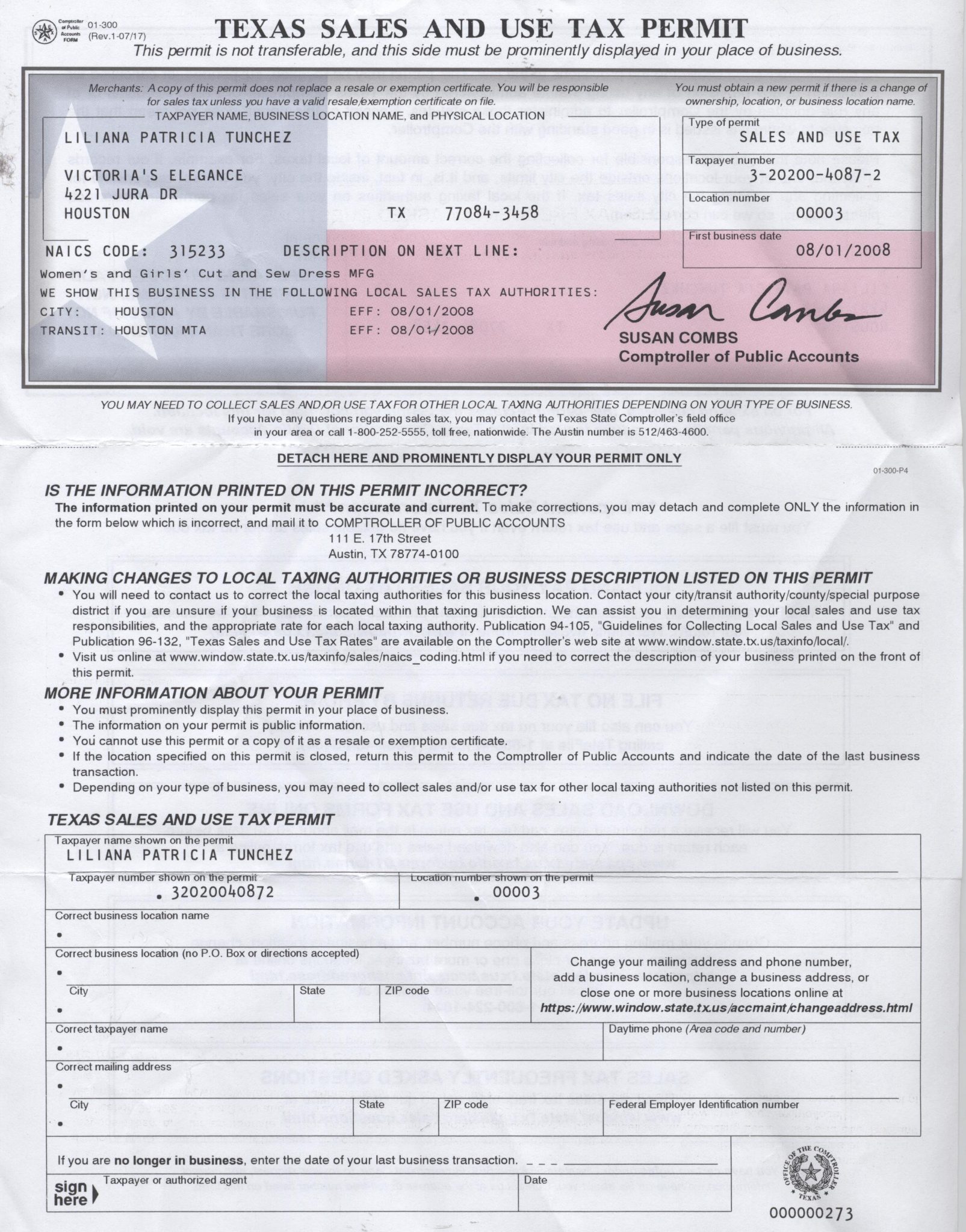

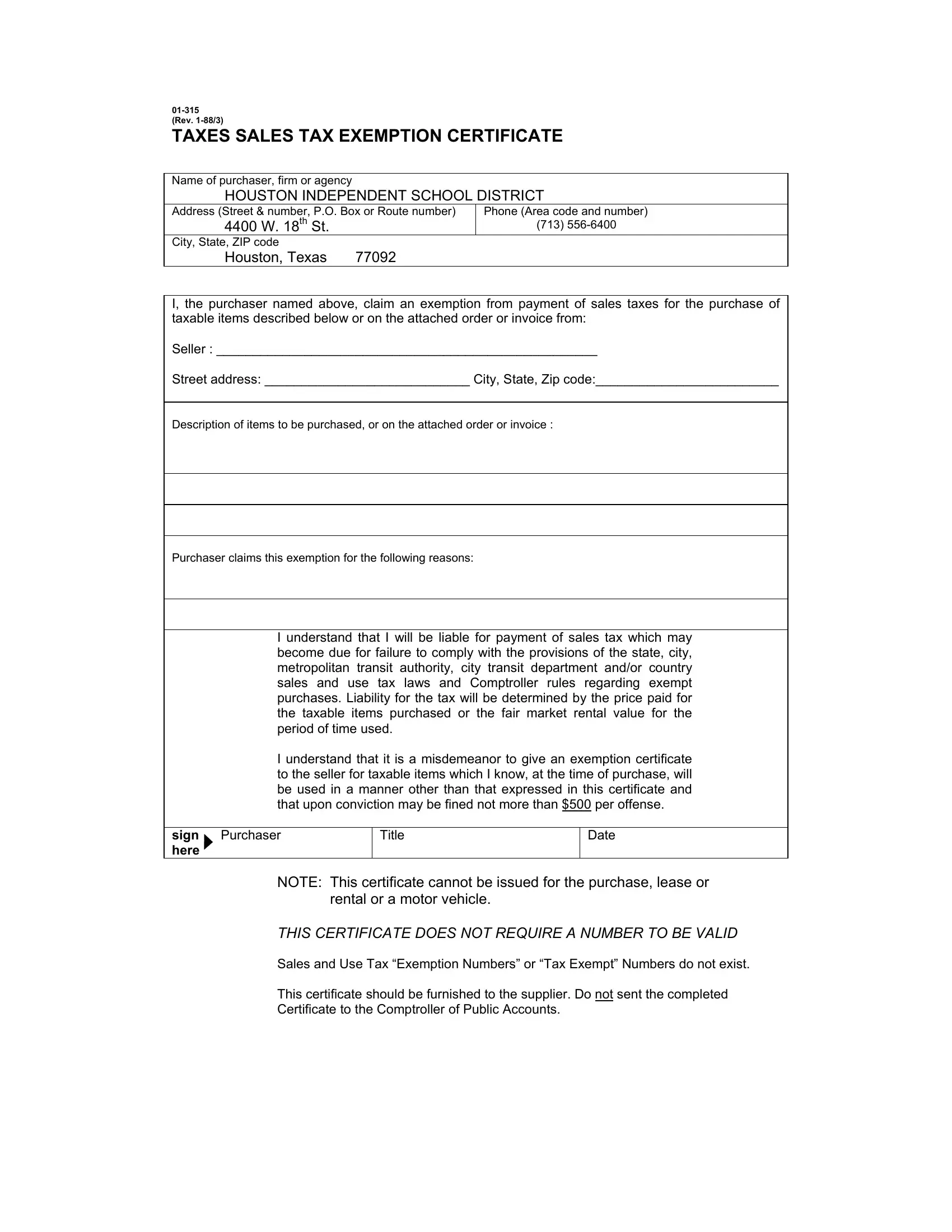

Webhow are vehicle sales taxed in texas? Texas sales tax on car purchases: Vehicles purchases are some of the largest sales commonly made in texas, which means that. This powerful tool simplifies the process, providing. Webtexans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 6. 25 percent on the purchase price or. Webmotor vehicle sales tax is due on each retail sale of a motor vehicle in texas. A motor vehicle sale includes installment and credit sales and exchanges for property, services. Weball texans who buy a used vehicle from anyone other than a licensed car dealer must pay sales tax on the vehicle's standard presumptive value, which is determined by using the.

Recent Post

- Zillow Edgewater Co

- Modern Burst Fade

- Downdetector Attcontribution Html

- Age To Work At Heb

- Days Of Our Lives Spoilers Who Killed Abigail

- Arrests In Chattanooga

- Obituaries In Marshfield Ma

- Old Churches For Sale In Nc

- Burst Fade Lightskin

- Jobs In Philadelphia Hiring 16 Year Olds

- Texasbenefits Gov

- Grand Junction Obituariessupport And Help Detail Html

- Stageagent Monologues

- Do Wet Dreams Count Nnn

- Gamarekian

Trending Keywords

Recent Search

- Abc Anchors Female

- Wonderland Liquor Anaheim Ca

- Criminal Sentence Calculator

- Denver Post Digital Replica Edition Sign In

- What Is Pisces Soulmate Signgames Html

- Train From Raleigh To Charleston

- Richest City In Chicago

- Akers Funeral Home Everett Pasupport And Help Html

- Hannaford Flyer

- Guest Payment Tmobile

- Yelp Content Moderator Job Work From Home

- What Is Roaming Data Verizonforum Open Topic Html

- Kroger Jobs Cypress Tx

- Imdb Empire Strikes Back

- Legacy Obituaries Elkhart Indiana